Financial Planning and Budgeting for Businesses

In today’s fast-paced world, financial planning and budgeting are vital to the success of any business, regardless of size or industry. Yet, for many business owners, these essential skills often feel overwhelming or complex. Enter Ashley K. Butler—a dedicated advocate for financial literacy and an expert in helping entrepreneurs take control of their business finances.

Through her engaging workshops and resources, Ashley inspires business owners to build strong financial foundations, set achievable goals, and implement systems that create sustainable growth. Let’s explore some of her top strategies and tools, including insights from powerful books and hands-on activities like the game Cashflow.

The Foundation of Financial Success

When working with Ashley, one of the first lessons she emphasizes is the power of mindset. She teaches that mastering financial planning and budgeting isn’t just about numbers—it’s about adopting systems that align with your long-term goals.

One standout concept she champions is "becoming your own banker," a principle explored in Nelson Nash's transformative book, Becoming Your Own Banker: Unlock the Infinite Banking Concept. This book highlights how individuals and businesses can leverage their finances to create self-sustaining systems, reduce dependency on traditional banks, and generate wealth over time. Ashley uses these principles to guide entrepreneurs in developing creative strategies for managing cash flow and reinvesting profits.

Another must-read in Ashley’s arsenal is Profit First by Mike Michalowicz. This book turns traditional accounting on its head by encouraging businesses to prioritize profitability from the start. Instead of the standard formula (Sales - Expenses = Profit), Michalowicz proposes a new mindset: (Sales - Profit = Expenses). Ashley helps business owners implement this profit-first philosophy by breaking down budgets into manageable, goal-focused steps that ensure profitability is baked into every decision.

Play the Cashflow Game

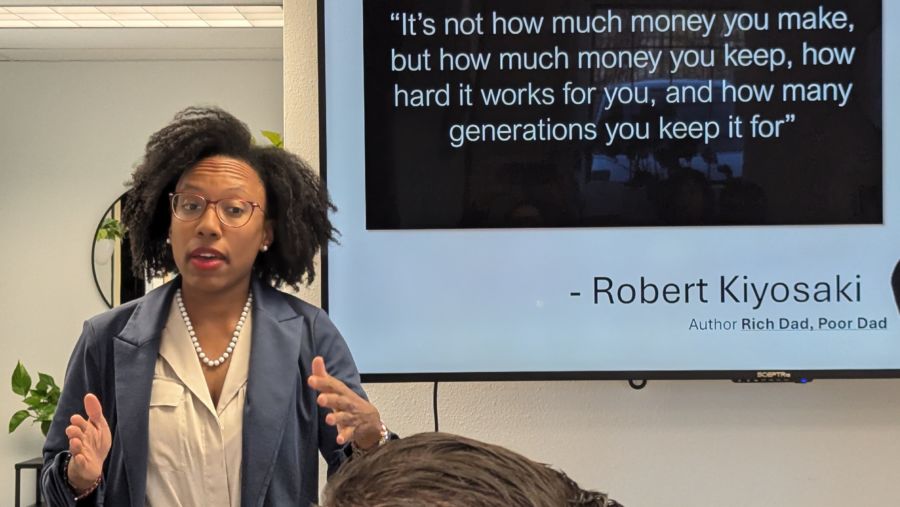

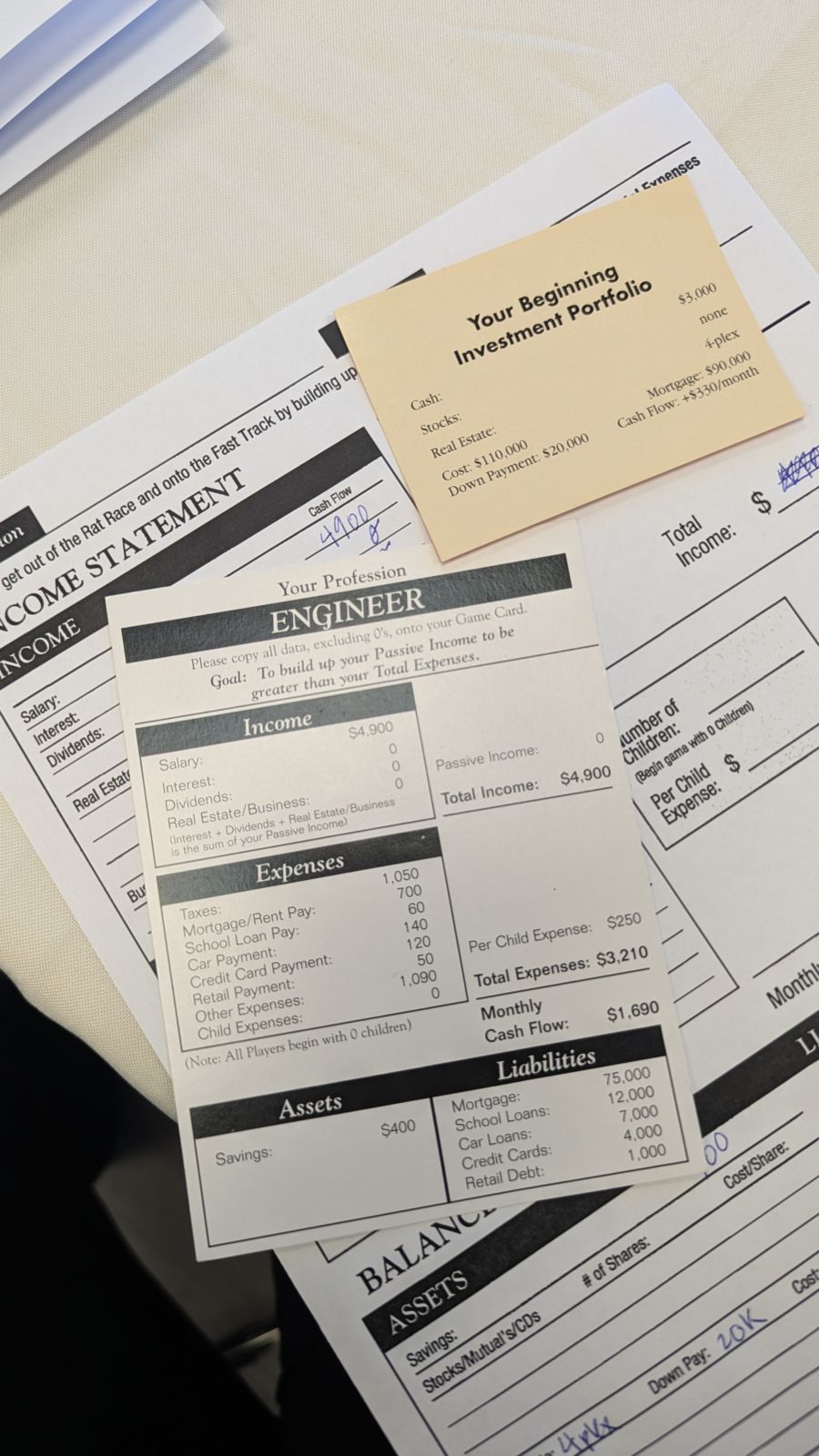

Ashley doesn’t just teach financial concepts—she makes them fun. One of her favorite tools is Cashflow, a financial education board game created by Robert Kiyosaki, author of Rich Dad Poor Dad.

This game teaches players how to manage income, build passive income streams, and escape the "rat race" through real-life financial decision-making. Participants learn to identify opportunities, manage risks, and understand the importance of reinvesting profits.

Ashley often incorporates Cashflow into her workshops, creating an interactive environment where business owners can experiment with financial strategies without real-world consequences. The lessons learned in the game are then applied to real-world business contexts, helping entrepreneurs strengthen their financial decision-making skills.

Don’t Wait—Get Started Today

One of Ashley’s most powerful tips for financial planning and budgeting is simple but profound: Don’t wait.

Waiting for the “perfect” time to start a budget or overhaul your financial strategy can cost your business both time and money. Instead, Ashley encourages business owners to take small steps now—whether that means setting up a savings account, creating a simple budget, or reading one of the recommended books.

Remember, financial planning doesn’t have to be perfect to be effective. The key is to start somewhere and refine your approach as you learn.

Practical Steps to Begin Your Financial Journey

Here are a few actionable steps inspired by Ashley K. Butler to help you take control of your business finances today:

- Educate Yourself: Read Becoming Your Own Banker and Profit First to gain insights into innovative financial strategies.

- Play to Learn: Gather your team and play Cashflow to explore financial concepts in an engaging way.

- Track Your Numbers: Start with simple bookkeeping and regularly review your income, expenses, and cash flow.

- Set Clear Goals: Define financial milestones, such as saving for a major investment or increasing profitability by a set percentage.

- Prioritize Profit: Implement the Profit First methodology by allocating profits before expenses.

- Seek Guidance: Don’t be afraid to consult with experts like Ashley to develop a tailored financial strategy for your business.

Achieve Financial Freedom

With the right tools, resources, and mindset, you can take control of your business finances and pave the way for long-term success. Ashley K. Butler’s practical, hands-on approach makes financial planning accessible, engaging, and achievable for business owners at every stage.

So why wait? Start today, and take that first step toward building a thriving, financially sound business.